Relationship Models and Fee Examples

At LifeGuide, we are driven to help as many people as possible to realize peace, achieve freedom and maximize their impact. We are a different kind of advisory firm. We have broken the traditional “one size fits all” approach to fees. All of our employees (including our advisors) are salaried. We use the lowest cost mutual fund and ETF share classes available to us and do not accept investment commissions or hidden fees (12b-1s).

We offer everyone a free introductory meeting to understand what they are looking for in an advisor and to further explain our service and fee structure. Our only requirement is that you complete our inquiry questionnaire before our meeting so that we can prepare for our discussion. Below is a summary of our three primary relationship models and their associated fee structures.

Relationship Model #1

One-time LifePlan Engagement

We work with you to create your comprehensive LifePlan.

Relationship Model #2

Ongoing LifePlanning, Coaching and Decision Support

We not only help you create your LifePlan- We journey with you to help make it a reality.

Relationship Model #3

Full-Service LifeGuide (our most popular)

Everything in Relationship Model #2 and we add in integrated investment management services.

We are a planning-centric, relationship-oriented, and highly analytical firm. We look forward to exploring if we are a good fit for you and your family’s needs. If needed, we can blend and adjust the fee and service structures listed below to address your specific situation.

Initial Consultation: Complementary Introductory Meeting

Getting to know each other.

Your first appointment with us is always free. Selecting a financial advisor is an important decision. The goal of this conversation is for us to get to know each other. We welcome your questions. We are interested in getting to know you and what you are looking for. We want you to understand who LifeGuide is, how we could best serve you, and what costs would be involved. We hope that by the end of the conversation you will be able to decide if we are a good fit for you, and we will be able to determine if we feel we are the right firm to help you.

As our gift to you, we always try to answer questions, provide a few tips, and offer some helpful perspective. We will also donate $50 to a charity of your choice from the LifeGuide Impact Fund as a thank you for spending time with us.

Relationship Model #1: One-time LifePlan Engagement

We work with you to create your comprehensive LifePlan.

We help you discover where you would like to go and develop a comprehensive plan for you to get there. Our LifePlanning process usually involves 2-3 meetings and takes about a month. Your LifePlan will answer your questions, provide clear next steps, highlight potential problem areas and stress test your plan. Are we going to be ok? What happens if one of us dies unexpectedly? Should I pay off my student loans or start saving for retirement? When should we begin taking our Social Security Benefits? How is the new tax law going to impact me? These are just some of the questions that we answer during a LifePlanning engagement.

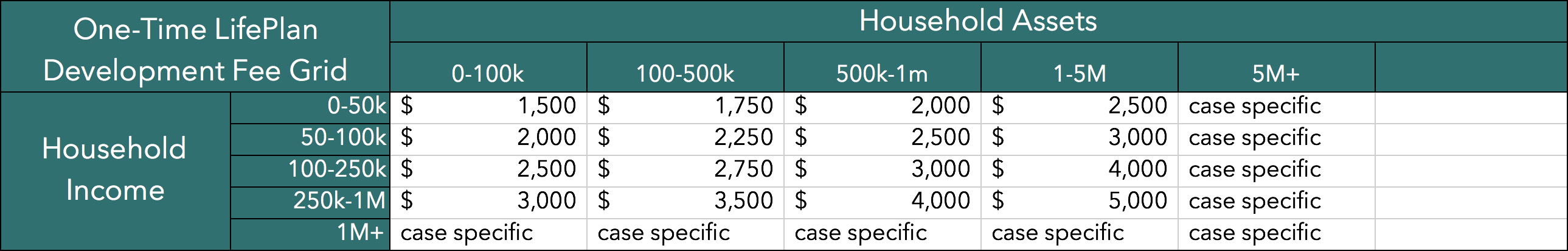

The grid below outlines the one-time engagement fee for our comprehensive LifePlanning engagement. Our LifePlanning single engagement fee is based on your household’s total income and includable assets. This fee includes a three-month subscription to LifeGuide 360, a personal financial website.

Relationship Model #2: Ongoing LifePlanning, Coaching and Decision Support

We not only help you create your LifePlan- We journey with you to help make it a reality.

Managing your finances can be complex. Life is busy, and it doesn’t always unfold as you have envisioned it. In Relationship Model #2, we help you implement your LifePlan while you maintain direct management of your investments. We help you dream about your preferred future and give you the confidence to go after it.

Your family’s financial future and security are too important to have continually put important tasks on the back burner. We help you make wise decisions, avoid costly mistakes and get things done. We take on as many of the details of implementing your plan as possible. Your LifeGuide team will manage action items, complete paperwork, and coordinate with your other advisors (CPA, Attorney, etc.)

After the initial construction of your LifePlan, we meet (virtually or in person) as needed (typically 1-3 times per year) to review action items, answer questions, and monitor progress. To help keep you on track, you have unlimited phone and email access to your advisory team and a subscription to LifeGuide 360, your personal financial website.

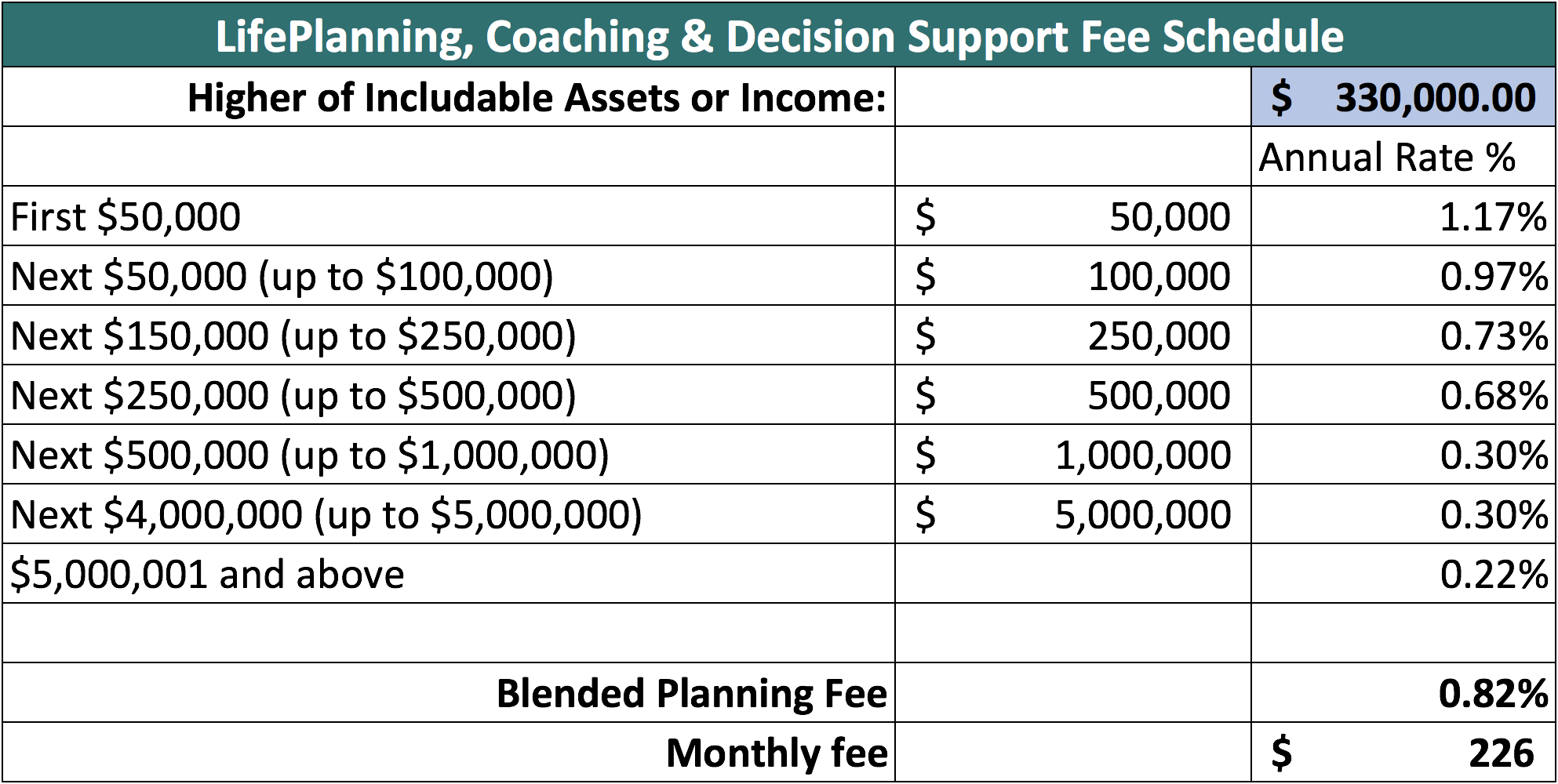

LifePlanning clients pay a monthly fee which we typically debit from your bank account or debit/credit card. We determine the monthly LifePlanning fee by applying the grid below to the higher of includable assets or income. LifePlanning clients do not pay upfront charges for the construction of their LifePlan. We ask that LifePlanning clients start with the intent of working with us for at least two years.

LIFEPLANNING FEE EXAMPLE: THE JONES FAMILY- The Jones’ have includable assets totaling $330k and a combined income of $175k. We apply the Jones’ includable assets ($330K) to the schedule above. Their annual rate is 0.82% of the $330k which results in a monthly LifePlanning fee of $225. (If the Jones’ were just starting out, had no assets, and an income of $45k, their annual rate would be 1.17% which would result in a monthly LifePlanning fee of $44.)

As we mentioned previously, LifePlanning clients are responsible for the management of their investment accounts. This fee structure allows us to serve clients who need planning, coaching and decision support services but do not invest money directly with us. Relationship Model #2 works well for individuals who have the majority of their investments in their employer plan (401k, 403b, PSERS, SERS, TSP, RIP) or want to manage their investments themselves. If you would like us to manage investments for you, Relationship Model #3 is for you!

Relationship Model #3: Full-Service LifeGuide (our most popular)

Everything in Relationship Model #2 and we add in integrated investment management services.

Managing your investment portfolio in today’s volatile economic and sensationalized media environment can be emotionally and analytically challenging. Which investments do you pick? Who do you listen to? What advice do you act on and when?

You work too hard to save for your children’s education, your future income needs, or that trip you have been dreaming about, to put your accounts on autopilot.

– Putting a value on your value: Quantifying Vanguard Advisor’s Alpha- March 2014

As a Full-Service LifeGuide client, you receive everything in Relationship Model #2, and we directly manage the accounts that you can move to us according to LifeGuide’s proprietary investment strategy.

We structure your investments to support the funding requirements of your LifePlan in the context of your current and future tax situation. We build your portfolio, weekly review your asset allocation (rebalancing as necessary), manage your RMDs, coordinate your withdraws and deposits and help with your charitable giving. LifeGuide’s IMPACT portfolio are available to you if you would like to have your investments aligned with your values.

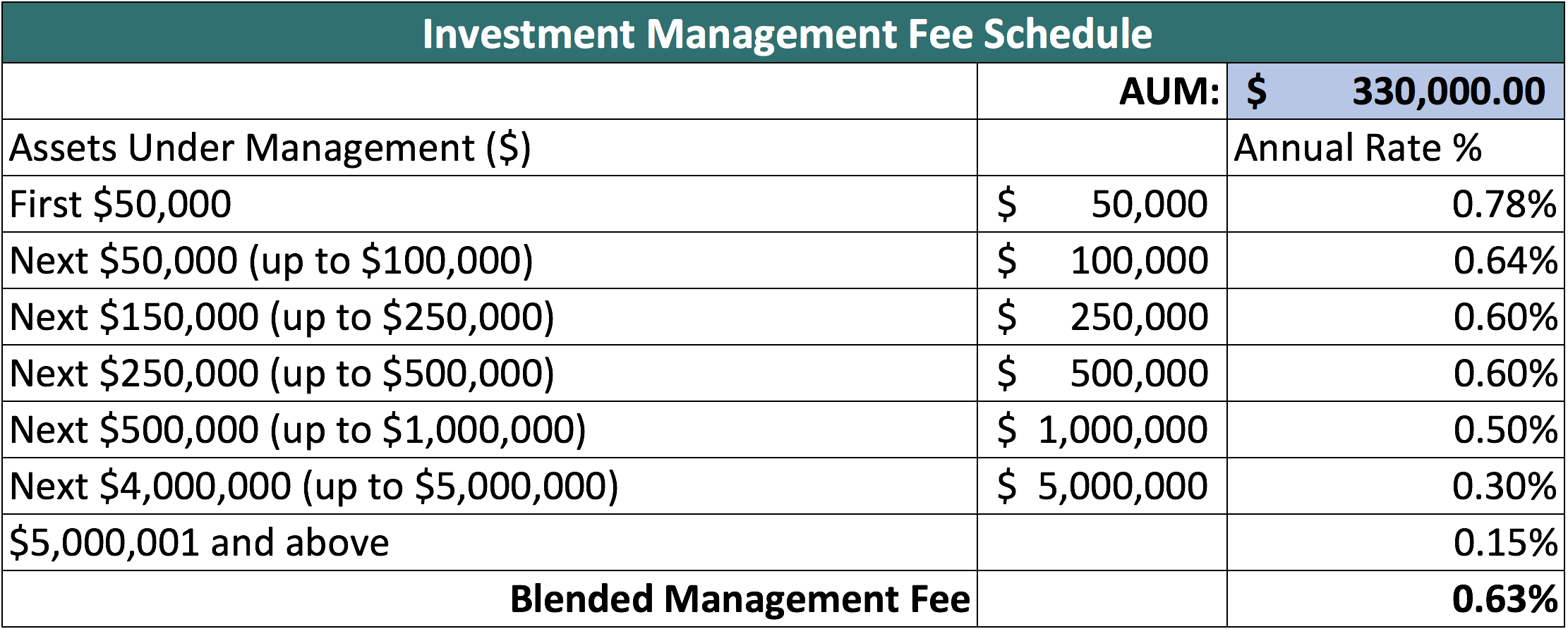

Full-Service LifeGuide clients pay a monthly implementation and investment management fee based on the assets under LifeGuide’s direct management. There are no upfront costs. LifeGuide pays all trading, account, IRA, transfer, ACH, and document fees for the accounts that we manage. Full-Service LifeGuide Clients are only responsible for any custodial account closing fees if charged.

FULL-SERVICE LIFEGUIDE FEE EXAMPLE: THE JONES FAMILY- The Jones’ have assets totaling $330k that they would like LifeGuide to manage. In addition to their Relationship #2 fee listed above, an annual fee of .63% would be charged on the $330k under LifeGuide’s management. We would be able to minimize or eliminate the monthly deduction from their bank account or debit/credit card by billing both Relationship 2 & 3 fees directly to their investment accounts held at LifeGuide.

Mutual fund and ETF expense ratios are in addition to LifeGuide’s fees listed above. Our portfolios use the lowest cost share classes available to us and we do not accept investment commissions or additional hidden fees (12b1s). We list our fees clearly in our monthly statements. We believe that you should know exactly what fees you are paying for the services you are receiving.

Thank you for taking the time to understand our relationship models. No matter how you choose to work with us, we are

committed to helping you get where you want to go and enjoy the journey of getting there.

We are happy to answer your questions and address your specific situation during our introductory meeting. We look forward to the conversation!

LifeGuide Financial Advisors, LLC is a registered investment advisor. Please visit our website www.lifeguidefa.com for important disclosures.